Note: click here for a PDF version of this article.

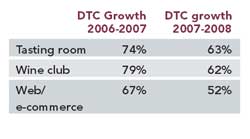

While direct to consumer (DTC) sales and club sign-ups have slowed somewhat due to the recession, many wineries are reporting continued sign-ups. The most successful wineries are using this time to hone their expertise and leverage the traffic that they are getting. Wine Business Monthly's fourth annual Tasting Room Survey Report takes a focused look at the trends in DTC sales as well as revisits those related to wine clubs and tasting fees.

Among responding wineries, 39 percent say that shipping and compliance issues remain the greatest barriers to DTC sales; however, shipping and compliance have become lesser issues in recent years as wineries have become more familiar with states' regulations and requirements.

At the tasting bar, slightly fewer wineries are charging for tastings since last year (down 2 percent), signaling a leveling off, and slightly more tasting rooms this year are applying the fee to wine purchases (up 4 percent).

As for cancellations, about two-thirds of wineries with wine clubs report an increase in membership cancellations over the past year ending in February.

Direct to Consumer Sales

This year's look at winery direct to consumer sales trends follows WBM's "2008 Consumer Direct Sales Survey Report" (August 2008 issue) format, showing data broken out into the two categories: "heroes" and "strugglers."

Heroes represent wineries that are selling a substantial number of cases consumer direct as well as showing growth in two or more DTC channels. They also work more successfully and efficiently when planning, executing and tracking their consumer direct sales programs. Strugglers, on the other hand, while not unsuccessful at consumer direct sales, could use improvement in various areas of their sales programs. Since size does not determine DTC success, a hero winery could be a small winery and a struggler could very well be a large winery.

|

Tasting rooms prove to be the most popular DTC channel by far (59 percent), followed by wine clubs (16 percent), events (8 percent) and the Web (8 percent) (Chart 1). The heroes sell a great deal more wine directly to consumers through their tasting rooms--27 percent more--than strugglers, but strugglers more often realize sales through their wine clubs, events and websites (with the Web being a particularly more active DTC channel for strugglers than for heroes).

Tasting room traffic, however, should not be the only source of DTC sales. "It's not enough in this economy," said Lesley Berglund, co-founder and chairman of Santa Rosa, California's WISE Academy (Wine Industry Sales Education), which specializes in direct to consumer marketing and sales. She reminds people to view tasting room traffic as the jumping-off point for all future relationships and thus emphasizes the ABCs of direct to consumer sales: Always Be Collecting--customer information, that is.

Jason Haas, general manager for Tablas Creek Vineyard (16,000 annual cases), a 120-acre organically farmed vineyard in Paso Robles, California, says that the winery is planning to boost their DTC from 50 percent to 60 percent through excellent customer service in their tasting room and wine club. "The thing about the wine club is that it will continue to grow naturally on its own," he said, noting that staffing for their busiest times and training employees to excel in personalized service will drive DTC growth. Currently 42 percent of the winery's DTC sales come from the wine club, 30 percent from the tasting room and 25 percent from the Web.

As more and more wineries look to increase their DTC sales, they encounter hurdles not seen when selling through trade distributors. When looking at the barriers to maximizing DTC potential (for all wineries), it is clear that issues related to compliance and shipping (39 percent) still outweigh all other barriers (Chart 2).

"There are so many state regulatory barriers relating to tax payments and licenses," said Ken Cain, general manager and director of sales for Tsillan Cellars Winery in Chelan, Washington (6,500 annual cases). "In many cases it's cost-prohibitive." In states such as Kansas and Tennessee, notes Cain, they can't ship there, period. While in other states like Nebraska, licensing costs and payments in advance (for bonds to cover taxes) are prohibitive. On the other hand, Cain notes that when the winery, which currently sells 90 percent of its wines via DTC channels, started waiving a portion of its shipping fees last year, sales increased.

Berglund, however, feels that while shipping and compliance issues were much bigger five years ago, they have lessened considerably since then; she suggests that the industry has moved into a "no excuses" zone because of the many software and online systems now available to help with shipping and compliance.

Other common barriers to maximizing DTC potential include: a lack of resources, such as people, time and money (17 percent); effective technology and systems (13 percent); acquiring customers (13 percent); and a lack of DTC marketing tools, such as those for customer relationship marketing (CRM) and Web analytics (13 percent).

Tasting Room Traffic and Fees

A single tasting room on the winery grounds is still the most popular tasting room arrangement, representing 75 percent of all wineries (Chart 3). Since 2006, this has become an even more popular choice, with 8 percent more wineries reporting a single tasting room located at the winery in 2009 than in 2006.

Fewer wineries are choosing to open tasting rooms not located at their winery site, dropping by 7 percent since 2006. Wineries with multiple tasting rooms (at least one located at the winery) grew by 3 percent in 2007, but the growth has remained constant since then.

Wineries most often see from 1,000 to 10,000 visitors in their tasting rooms each year (39 percent). About 19 percent of wineries see fewer than 1,000 visitors annually, and 31 percent see more than 10,000 a year.

While many tasting room managers are reporting a decrease in traffic, there is still much that can be done to reach out and boost sales, mainly through collecting as much customer information as possible and tracking and managing conversion rates, Berglund said. "Upping your conversion rate for your wine club, for example, can be achieved with your current flow of visitors by evaluating how your staff presents the offer and providing them with additional training," she said, noting that there is often a fear of asking for the order. "But the people are there, they want to have a relationship with your brand; they're saying, 'Hey, ask me out,' but they're not being asked out."

Since 2006, WBM has been tracking whether tasting rooms charge for tastings, and this year's numbers suggest that things have leveled off. For 2009, a total of 63 percent of all wineries said they now charge for tastings, compared to 65 percent in 2008, 59 percent in 2007 and 51 percent in 2006.

Additionally, more tasting fees are being applied to purchases: 52 percent of tasting rooms now apply tasting fees to the purchase of wine, slightly up from last year's 48 percent and 2007's 41 percent. Undoubtedly, tasting room visitors are now accustomed to tasting fees since the practice has become commonplace. Additionally, as wineries and tasting rooms are learning to add more value and personalization to their products and services, visitors find fees less objectionable.

The trend of increasing tasting fees seems to have leveled off in 2009. Fees are most commonly in the $3 to $5 range (51 percent), with only 9 percent charging less and 39 percent charging more.

Wine clubs

Sixty-four percent of wineries now have wine clubs, with 44 percent being a traditional club with multiple shipments each year. Fifteen percent of wineries have multiple types of wine clubs, and 18 percent say they are planning a club in the future (Chart 4).

Tasting rooms continue to drive new wine club member sign-ups (77 percent) (Chart 5). A smaller percentage of club members join via the Web (7 percent) and during consumer events (6 percent). Strugglers find a greater percentage of club members from the Web and from events than hero wineries, who appear to focus most of their efforts on tasting room traffic. Additionally, strugglers get more member sign-ups through referrals than heroes do.

Wineries report that once visitors are in the tasting room, piquing their interest about joining the wine club does not need to come from a hard-sell approach. "We avoid sales techniques that push the club and instead sell it through staff enthusiasm," said Haas of Tablas Creek. "During the course of a tasting, staff members may point out our club shipment display or mention that the wine they're currently pouring goes out in club shipments." Haas, who notes that about 6 percent of their tasting room visitors end up signing up for the club, says there has been no slowing in sign-ups.

Overall, club member attrition is fairly low, despite the weak economy. Just over half of wineries that have clubs report losing less than 1 percent of their membership each month on average; this is followed by 17 percent of wineries who lose less than 2 percent of memberships and 10 percent who lose less than 3 percent of memberships (Chart 6). (For tips on keeping members in the club, see "Maintaining a Healthy Wine Club in an Uncertain Economy," WBM, March 2009 issue.)

"Relative to what's going on with other wineries, we've seen few cancellations," said Cain of Tsillan Cellars. "And we are getting new sign-ups, just not at the same rate as before." Cain adds, however, that it's a hard time to gauge right now (March) since it's the slow time of year and things don't usually pick up until June.

Hump Astorga, director of hospitality and culinary operations at Chrysalis Vineyards in Middleburg, Virginia (10,000 cases), says that business has been good in their tasting room in the last year. "Our wine club membership has tripled in number since 2007," he said. "You don't build a group like this without providing a complete experience for visitors." Astorga said this includes a thorough presentation where you tell a story and paint a picture, educate, entertain, taste great wine and, of course, ask for the sale. "While it's not a hard sell, we do train our staff to ask for the sale, whether it's for the wine or the wine club," he said, adding, "It's not just romance; we need to succeed as a company."

Looking at the year from February 2008 to February 2009, 66 percent of wineries with clubs reported an increase in club cancellations. The average increase in cancellation was 34 percent, contrasted with 28 percent the year before (January 2008 to January 2009) (Chart 7).

Charles Hesson, retail sales manager for Dobbes Family Estate (5,000 cases) and Wine By Joe (20,000 cases) in Dundee, Oregon, said their wine club cancellations have been erratic. "In October it was like someone had cut our jugular; we were losing maybe one club membership a day," he said, noting that they lost about 50 club members October 1 through the end of November. Things started slowing down when they began offering options to members, such as smaller, less frequent shipments, which Hesson said has been effective about 90 percent of the time.

Cain of Tsillan says his winery began to offer more options to club members so they could continue their memberships at a lower price. "We started offering a reduced club, with smaller discounts and fewer shipments with the option to upgrade later, and about half the people who called to cancel have gone for this," he said. Cain noted that for those who opt out completely, in many cases it's due to a job loss as opposed to others who may be just trying to cut back.

Wine club members appear to be staying in clubs even longer than the average of 18 months often quoted by tasting room experts. Twenty-two percent of wineries report that their members stay in their wine club "19 to 24 months," followed by "25 to 36 months" (18 percent) and "more than 36 months" (17 percent) (Chart 8). Only 11 percent indicated "13 to 18 months." Forty percent of heroes noted that their club members stick around "25 to 36 months" while only 5 percent of strugglers noted that their members stayed in their clubs for this long.

Regular communication and customer service are keys to club member retention, but there are other ways that wineries strive to recruit and keep members. "We are focusing more and more on holding consumer events in places where we can actually direct ship the wine," said Haas of Tablas Creek. "While we can do trade events anywhere, it's hard if we can't end up shipping to consumers there."

Half of all wineries say that the average annual expenditure by club members for wine purchases beyond their periodic club shipments falls into the "$100 to $500 per year" category (Chart 9). Slightly more heroes (60 percent) than strugglers (49 percent) say this is the average annual expenditure by club members (the next most popular average falls in the "$1 to $100" category).

Club members in many cases are not deterred by the economy when it comes to supporting their favorite winery and the special connection they feel with their club. Hesson of Dobbes Family Estate stated his surprise at how much his winery's club members spent at a recent release event. "An average sale for this type of event on this day is about $5,000, and we ended up making about $6,000," he said. One club member told Hesson that while they don't eat out much anymore, satisfied to cook at home, their favorite wine is something they are less willing to part with. "Plus," said Hesson, "for most of these people, being in the wine club is a very social thing, and they can't wait to come to events."

Tactics to remember

As wineries and tasting rooms continue to develop their DTC sales skills and techniques, they will undoubtedly realize increased sales. Key areas to revisit include collecting customer information at every available opportunity as well as tracking conversion rates and using this information to better manage sales. The more information you have, the more targeted your decisions will be. Employing these tactics, in addition to what tasting rooms are already doing so well, including personalizing service and offering added-value experiences, is a sure recipe for success during uncertain times and beyond. wbm

Cathy Fisher lives in Sonoma and has been writing about the wine industry for four years.

Survey

Respondents

This year's survey received a total of 406 responses, including 154 from California, 48 from Washington, 42 from Oregon, 15 from Virginia, 12 from New York and 9 from Texas.

Fifty-five percent of responding wineries produce fewer than 5,000 cases annually, another 30 percent produce 5,000 to 24,999 cases, and the remaining 15 percent produce 25,000 or more cases (2 percent of which produce a million cases or more).

Sixty-seven percent of survey respondents reported their job title as president/owner/GM, 47 percent work in the tasting room, and 47 percent in sales and marketing (respondents were able to choose more than one function).

The purpose of the survey was to determine trends in tasting room practices and procedures. Please note that the findings of this survey are meant to offer a general picture of tasting room trends and practices. It is not a scientific study, and should be used only as a tool and a point of reference for further inquiry.

Thank you to all respondents who participated in this year's survey.

What is your job function?

(check as many as appropriate)

Winemaking 36%

Predident/owner/GM 67%

Cellar/Production 24%

Purchasing/Finance 30%

Vineyard Mgmt/Viticulture 19%

Tasting Room 47%

Sales/Marketing 47%

Other 7%

Please indicate winery size

(annual case production)

0/NA 2%

Under 1,000 14%

1,000-2,499 22%

2,500-4,999 17%

5,000-9,999 17%

10,000-24,999 13%

25,000-49,999 5%

50,000-99,999 3%

100,000-249,000 2%

250,000-499,999 2%

500,000-999,999 1%

1,000,000 and over 2%

The majority of your wine is sold at which retail bottle price point range?

< $7 2%

$7-$9.99 2%

$10-$13.99 14%

$14-$24.99 45%

$25-$49.99 32%

$50-$100 5%

over $100/bottle 0%